Driving Direction from NY to London

"Driving" Direction from NY to London, according to the smart a$$ GoogleMap. Be sure to check out step 23.

My life in Finance, Economics and Computer Science

"Driving" Direction from NY to London, according to the smart a$$ GoogleMap. Be sure to check out step 23.

Ever wonder why there is WCF (Windows Communication Foundation) and WPF (Windows Presentation Foundation) but Windows Workflow Foundation is only called WF? This slide probably explains it:

The WWF (World Wildlife Foundation) even forced World Wrestling Federation to rename itself to WWE (World Wrestling Entertainment). In a word, don't mess with the panda!

Seriously, here is world’s most trivial and useless Windows Workflow Foundation (WF) application, best for beginners.

The WWF (World Wildlife Foundation) even forced World Wrestling Federation to rename itself to WWE (World Wrestling Entertainment). In a word, don't mess with the panda!

Seriously, here is world’s most trivial and useless Windows Workflow Foundation (WF) application, best for beginners.

Posted by

MING CHEN

at

3:07 PM

![]()

Category: Technology

The oldest comment I found while poking around the XLL project is dated Nov, 1996, a bit over ten years ago. I probably wrote my "hello, world" in C around the same time.

Anyway, the goal is to call the excel plugin functions in C#/.NET. This should be straight forward, at least in theory: XLL files are merely DLLs with a few special functions. There is no reason they can't be loaded and called via DllImport.

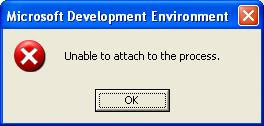

However, the following code throws a DllNotFoundException, and GetLastErr promptly returns no error code:

[DllImport("myxll.xll", EntryPoint="GetVersion")]

public static extern string XLGetVersion(); Digging a bit deeper with Depends, I found an excel library called XLCALL32.DLL, referenced by the XLL is the cause of trouble. The library can't be loaded with LoadLibrary outside Excel. I suspect that has something to do with the mysterious looking importing variable shown in the right panel below.

IntPtr ptr = LoadLibraryEx("XLCALL32.DLL",

IntPtr.Zero, DONT_RESOLVE_DLL_REFERENCES);Then the old P/Invoke trick turns back on (because XLCALL32 has been loaded). This obviously won't work if the XLL contains callback functions into Excel. But for everything else, there is DllImport...

And here is a reference to the structure of XLL files. (link to complete e-book).

Posted by

MING CHEN

at

12:16 PM

![]()

Category: Technology

During the past two years, I have been walking completely backwards on the path of technology innovation:

Posted by

MING CHEN

at

2:52 PM

![]()

Category: Technology

BlackStone's planned IPO is definitely the latest hype in the PE space. The pros are already having fun with its S-1 filing. WSJ/BreakingViews suggests that the managing directors at BlackStone should actually take a pay cut in order to maximize their personal wealth.

Time to create a list of tools I have been using in my current project before jumping into a new bunker next week:

Posted by

MING CHEN

at

1:18 PM

![]()

Category: Technology, Tools

A WSJ piece on Chinese Property Rights (the second part, after Citigroup's ABN Opening).

China's new law guaranteeing private owners the same rights as public and collective entities might sound like a capitulation to capitalist ideology. Not so, says National People's Congress Vice Chairman Wang Zhaoguo. Equal property rights are required to "uphold and improve the basic economic system of socialism." Whatever the words, Adam Smith would approve. ... And if 1.3 billion Chinese want to call it "socialism," why argue?Welcome to the world of "Socialism with Chinese characteristics".

The stock market and Yen have been trading in locked oppsite steps in the past few weeks. See DJIA and JPY 3 months daily chart above (the JPY chart is in Yen per Dollar).

Does this mean that the power of yen carry trade is in its full force? When the stock market advances, speculators borrow more yen, convert them into dollar and invest in the market, hence contributing to the depreciation of JPY; when the trend in stock market is reversed, they unwind their positions and repay the Yen debt, pushing JPY up.

The carry trade schema is no more sustainable in the long term than US current account deficit. The reversal of a depreciating yen could pose serious threat to equity investors. Could subprime or the emerging market problems pull the trigger? There is no way to know...

The stock market and Yen have been trading in locked oppsite steps in the past few weeks. See DJIA and JPY 3 months daily chart above (the JPY chart is in Yen per Dollar).

Does this mean that the power of yen carry trade is in its full force? When the stock market advances, speculators borrow more yen, convert them into dollar and invest in the market, hence contributing to the depreciation of JPY; when the trend in stock market is reversed, they unwind their positions and repay the Yen debt, pushing JPY up.

The carry trade schema is no more sustainable in the long term than US current account deficit. The reversal of a depreciating yen could pose serious threat to equity investors. Could subprime or the emerging market problems pull the trigger? There is no way to know...

Think you know what volatility is? Think again:

A stock (or a fund) has an average return of 0%. It moves on average 1% a day in absolute value; the average up move is 1% and the average down move is 1%. Assume that we live in the Gaussian world in which the returns (or daily percentage moves) can be safely modeled using a Normal Distribution. Assume that a year has 256 business days. The following questions concern the standard deviation of returns (i.e., of the percentage moves), the "sigma" that is used for volatility in financial applications. What is the daily sigma? What is the yearly sigma?See this paper for the answers. This probably doesn't have much real world implication though. Once presented the full time serie of stock prices, instead of this "on average" stuff, I can't imagine any one would make similar mistake.

The best articles(one, two) I have read on AJAX, SOA and EDA in the context of Enterprise Architecture.

Most of the time, the nature of these technologies is much simpler than the marketing gurus would like us to believe (I understand ROI is important. But a paper talks about nothing but ROI hardly helps on that front). Or the arguments about the literal of terms ("SOA and EDA, who is the father" type, do I sense another StarWars comic?).

SOA and EDA are simple design patterns, or reusable designs to solve common problems. (I always think of EDA as some combination of the old "chain of responsibility" and "observer" patterns). While SOA is a pattern focusing on decoupling the functioning components and implementing a tight control relationship among them, EDA focuses on integrating loosely-coupled components and services. The following graph from the article summerizes it nicely:

UPDATE: Among the comments of the original article, Gerry posted:

UPDATE: Among the comments of the original article, Gerry posted:

Come on guys, this is trivial stuff. SOA and EDA are NOT rocket science. SOA is just another way of enforcing loose coupling and high cohesion. EDA is so trivial (and as a concept has been around for decades) that I can't believe its being bandied around as the 'next big thing'. Sigh, I think I've been in this business too long.My feeling exactly.

Posted by

MING CHEN

at

11:09 AM

![]()

Category: Technology

An article on Gamma Scalping, the option trading strategy that takes advantage of the difference between implied vol and realized vol, not easy to find in any introductory option trading materials.

Once up a time, we were happy playing games like this:

Yet today, we call Games with DVD quality picture "low resolution". So what's next? The Virtual Reality Helmet? How far are we to The Matrix? And are we really heading to the right direction?

Anyway, just some random thoughts while reading the history of "Legend of Zelda" series.

UPDATE: Speaking of which, Shigeru Miyamoto, the designer of the series, just received Lifetime Achievement Award today on Game Developers Conference 2007.

Posted by

MING CHEN

at

3:50 PM

![]()

Category: Audio and Video, Pointless

| The story of $25 billion buyout of RJR Nabisco Corporation, a record KKR kept for almost two decades. An interesting read when today's LBOs are getting bigger and bolder. |

Posted by

MING CHEN

at

5:22 PM

![]()

Category: Finance, LBO, Reading List

There has been a lot of talk on how last week's rout indicates China's stock market has become an integrated part of global capital market. To put things in perspective, I've put togather the following data comparison from various sources(news releases from NYSE and SSE, CIA World Factbook):

China US

-------------------------------------------------

GDP ($ Trillion) 2.50 13.22

SSE NYSE

-------------------------------------------------

Total Market Cap. 895.15 24,500

Floating Shares 205.35 N/A

Percent of GDP 8% 182%

2006 Volume (in $) 715.56 21,730

2006 Daily Volume (in $) 2.97 86.92

2006 Daily Volume (in Share) 3.41 2.35

* Dollar and share amounts in billions.

* Assume an average exchange rate of 8.

One obvious advantage of using MSBuild over NAnt is that Visual Studio 2005 uses MSBuild script as its default project file format. However, when you want to get your hands dirty on the details of MSBuild files, you'd likely find that the documentation is not as organized as NAnt help in MSDN. Here are two places that might give you a quick start on MSBuild:

Posted by

MING CHEN

at

2:40 PM

![]()

Category: Technology

<configuration>

<startup>

<supportedRuntime version="v1.1.4322"/>

</startup>

</configuration>It seems this config file would force Excel to load 1.1 version of the Runtime. But why would an unmanaged executable such as Excel require .Net runtime (even without the plugin) in the first place is beyond my understanding.

Posted by

MING CHEN

at

4:32 PM

![]()

Category: Technology

Warren Buffett’s 2006 Letter to Shareholders. Some interesting remarks:

Don't think, however, that we have lost our taste for risk. We remain prepared to lose $6 billion in a single event, if we have been paid appropriately for assuming that risk... Our behavior here parallels that which we employ in financial markets: Be fearful when others are greedy, and be greedy when others are fearful.

We sometimes encounter accounting footnotes about important transactions that leave us baffled, and we go away suspicious that the reporting company wished it that way. (For example, try comprehending transactions "described" in the old 10-Ks of Enron, evenafter you know how the movie ended.)

The "optional" contracts and "teaser" rates that have been popular have allowed borrowersto make payments in the early years of their mortgages that fall far short of covering normal interest costs. Naturally, there are few defaults when virtually nothing is required of a borrower. As a cynic has said, "A rolling loan gathers no loss." But payments not made add to principal, and borrowers who can't afford normal monthly payments early on are hit later with above-normal monthly obligations. This is the Scarlett O'Hara scenario: "I'll think about that tomorrow." For many home owners, "tomorrow" has now arrived.

As our U.S. trade problems worsen, the probability that the dollar will weaken over time continues to be high. ...Like a very wealthy but self-indulgent family, we peeled off a bit of what we owned in order to consume more than we produced. These transfers will have consequences, however. Already the prediction I made last year aboutone fall-out from our spending binge has come true: The "investment income" account of our country---positive in every previous year since 1915 --- turned negative in 2006. Foreigners now earn more on their U.S. investments than we do on our investments abroad. In effect, we've used up our bank account and turned to our credit card. And, like everyone who gets in hock, the U.S. will now experience "reverse compounding" as we pay ever-increasing amounts of interest on interest.

The answer is that derivatives, just like stocks and bonds, are sometimes wildly mispriced. For many years, accordingly, we have selectively written derivative contracts --- few in number but sometimesfor large dollar amounts. We currently have 62 contracts outstanding. I manage them personally, and they are free of counterparty credit risk.

When I talked about Walter 23 yearsago, his record forcefully contradicted this dogma [EMT]. ... The faculties of the schools went merrily on their way presenting EMT as having the certainty of scripture. Typically, a finance instructor who had the nerve to question EMT had about as much chance of major promotion as Galileo had of being named Pope. Tens of thousands of students were therefore sent out into life believing that on every day the price of every stock was "right" (or, more accurately, not demonstrably wrong) and that attempts to evaluate businesses --- that is, stocks --- were useless. Walter meanwhile went on overperforming, his job made easierby the misguided instructions that had been given to those young minds. After all, if you are in the shipping business, it's helpful to have all of your potential competitors be taught that the earth is flat.